Not Always! Especially during market downturns

Stock Market Translation of famous Shakespeare's quote would be “Market is a Laughter Club and most of us are funny creatures.”

Many of us exhibit the highest level of personal intelligence and utopian wisdom every day from 3.30PM to Next day 9.15AM and on weekends and public holidays. So the problem hours are 9.15AM to 3.30PM – where we exhibit actions may be different from what we recite during hours of our superior intelligence. This is what I think is ‘misalignment of Words and Actions’.

Do we always behave this way?

My answer would be a resounding No!

In bull markets when stock prices are going up and being the optimist, we all are at heart – our positive stance is very much aligned with our actions (aka market positions). But, suddenly things go haywire when market is in a drawdown phase / bear phase etc. During these times we may be negative on markets, but our actions are not aligned to our words.

When I talk to friends, fellow investors, market researchers around me and ask for their view on market – many of them are negative and the thesis is very strong as well (please note some of these are very smart people). But my next question about ‘So what have you done to your portfolio / how are you positioned?’ – many can’t convince me that they have fully expressed their negative views in terms of their positioning.

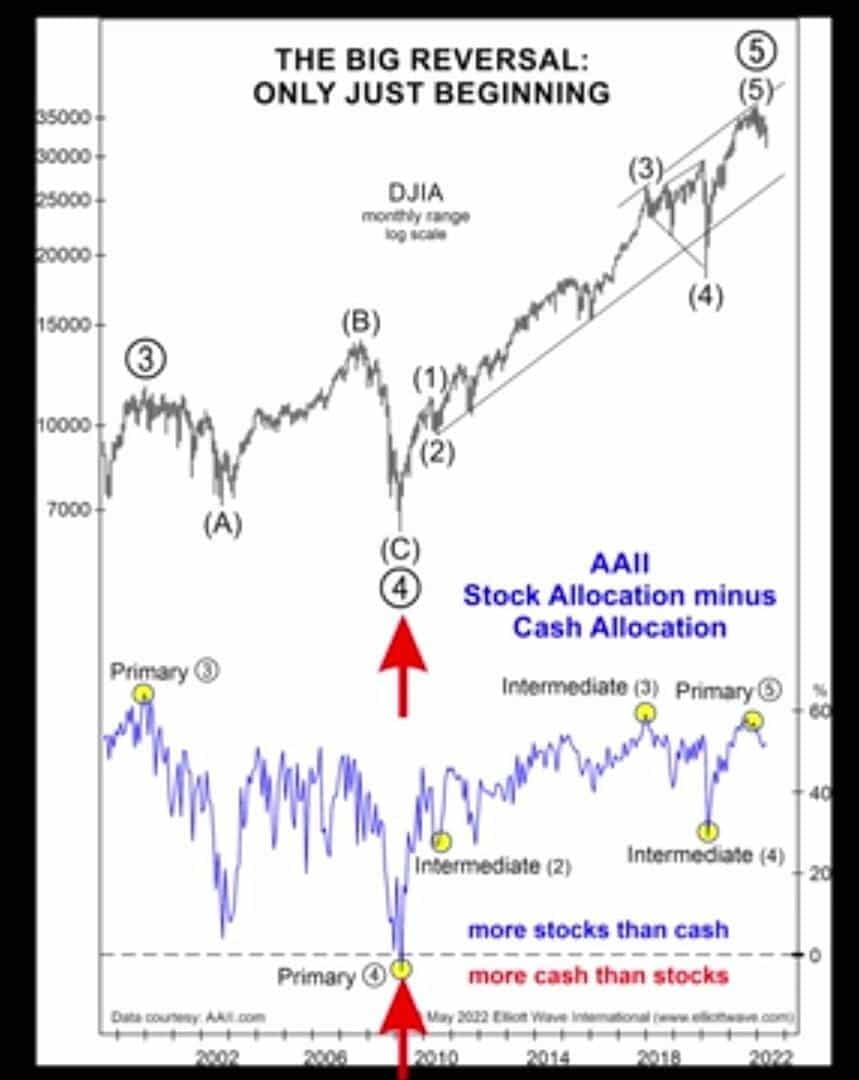

At this point my belief in wisdom of crowds gets shaken. Wisdom of crowd is only valid if the crowd acts on it and not just says what they feel. Recently, I came across a very interesting chart from Elliott Wave institute (below) which captures market moves and investors market positioning. The chart is shown below just to depict negative sentiment is not followed by market positioning and doesn’t intend to give doomsday forecast.

Main conclusion is despite negative sentiment, investors equity holdings are not reflecting the same. One of the likely reasons is the recency bias for investors, where every dip should be bought mindset or hope of a V shaped recovery even when Government and Central Banks across the globe are tightening their purse strings. Some of this was echoed in recent interview by Seth Klarman with Harvard business school – the three main points from the interview were:

• "We see today's market as characterized by stretched valuations, deep complacency, and a host of looming risks."

• "We believe that mounting inflation and the related possibility of materially higher interest rates are posing a real danger to financial markets.

• "Against a backdrop of relentless money printing, a very active Federal Reserve, and fiscal largesse, many investors have been lulled to sleep, unaware of and unfocused on risk. They are like the cat that didn't jump on the hot stove."

Interesting thing about these quotes from Klarman, he has expressed this sentiment by buying hedges against Baupost’s portfolio.

To my gut we are not at the bottom yet and this will not be a V shaped recovery and I am positioned accordingly in my small capacity.

Point worth thinking over the weekend.

If you find these posts useful, please share it anyone who can benefit from our content. And subscribe to our Substack so you don’t miss out on future posts.